The company was founded by Thomas Alva Edison in 1878 and is headquartered in Boston, MA.

#Aercap share price history pro

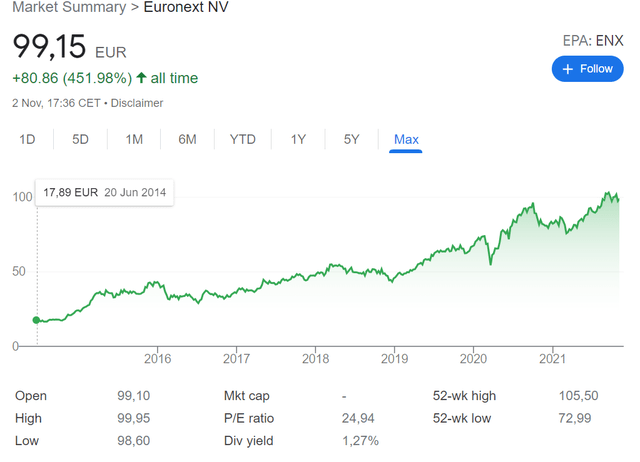

The Power segment serves power generation, industrial, government and other customers worldwide with products and services related to energy production. The following unaudited pro forma combined financial information is based on the historical financial statements of AerCap and ILFC and is intended to provide. Our technical summary section provides analysis on AerCap Holdings NV share price buy/sell indicators using real-time data (or discuss the AerCap Holdings NV (AER) share price today with other investors in the AerCap. The Renewable Energy segment’s portfolio of business units includes onshore and offshore wind, blade manufacturing, grid solutions, hydro, storage, hybrid renewables and digital services offerings. Analyse historical data and AerCap Holdings NV share price performance charts and whether the stock is buy or sell on this page.

The Healthcare segment provides essential healthcare technologies to developed and emerging markets and has expertise in medical imaging, digital solutions, patient monitoring and diagnostics, drug discovery and performance improvement solutions. The Aviation segment designs and produces commercial and military aircraft engines, integrated engine components, electric power and mechanical aircraft systems. (AER) Stock Price & News - Google Finance Markets Dow Jones 34,576.59 +75.86 4,457.49 +0.14 13,761.52 +0.092 1,851.54 -0.23 -4.21 -0.56 Home AER NYSE AerCap Holdings. It operates through the following segments: Aviation, Healthcare, Renewable Energy, and Power. engages in the provision of commercial and military aircraft engines and systems, wind, and other renewable energy generation equipment and grid solutions, and gas, steam, nuclear, and other power generation equipment. For example, we've discovered 3 warning signs for AerCap Holdings (2 make us uncomfortable!) that you should be aware of before investing here.General Electric Co.

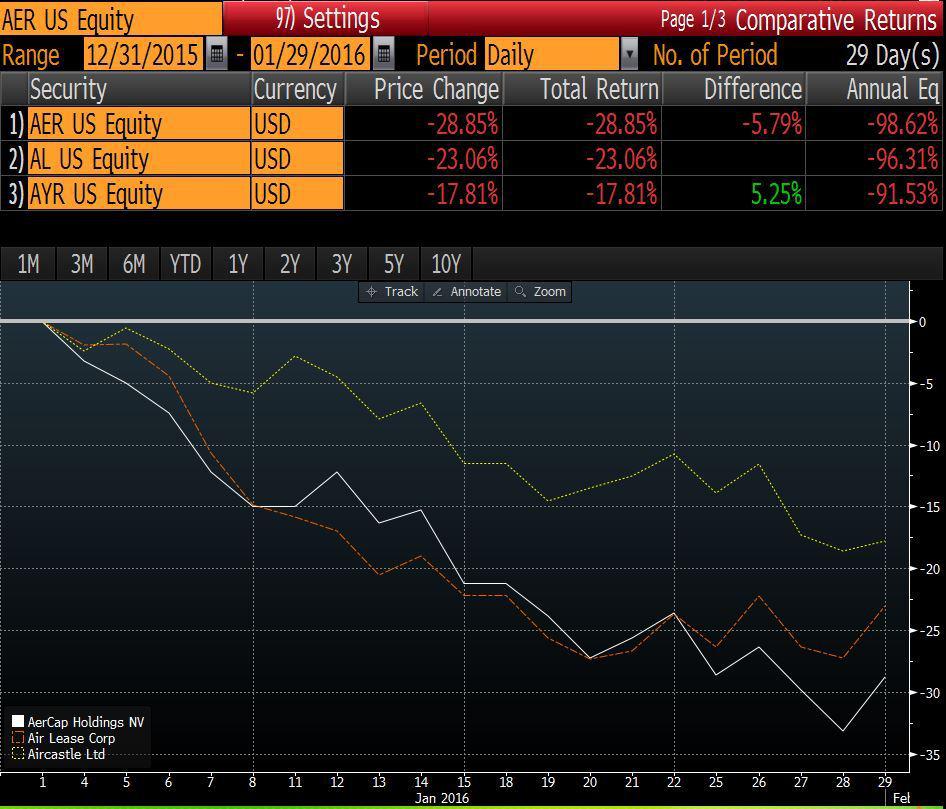

But to understand AerCap Holdings better, we need to consider many other factors. It's always interesting to track share price performance over the longer term. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6.0% over the last half decade. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Investors in AerCap Holdings had a tough year, with a total loss of 50%, against a market gain of about 17%. We know that AerCap Holdings has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for AerCap Holdings in this interactive graph of future profit estimates. You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values). However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment. Revenue was fairly steady year on year, which isn't usually such a bad thing. So it's easy to justify a look at some other metrics. It's surprising to see the share price fall so much, despite the improved EPS. It could be that the share price was previously over-hyped. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).ĭuring the unfortunate twelve months during which the AerCap Holdings share price fell, it actually saw its earnings per share (EPS) improve by 12%.

01, 2022 AER STOCK PRICE DECREASE: Aercap Holdings NV on 03-01-2022 decreased stock price > 10 from 62.81 to 54.43. What is the trend in the AerCap Holdings NV share price An important. 09, 2022 AER STOCK PRICE INCREASE: Aercap Holdings NV on 03-09-2022 increased stock price > 10 from 43.89 to 48.63. There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. Ord/AerCap Holdings NV Dividend Stock News and Updates. See our latest analysis for AerCap Holdings Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days.

To make matters worse, the returns over three years have also been really disappointing (the share price is 43% lower than three years ago). To wit the share price is down 50% in that time. ( NYSE:AER) stock has had a really bad year. And there's no doubt that AerCap Holdings N.V. Investing in stocks comes with the risk that the share price will fall.

0 kommentar(er)

0 kommentar(er)